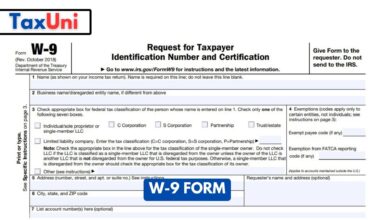

W9 Form Printable

The W-9 form, a Request for Taxpayer Identification Number and Certification, is an essential tool businesses use to collect information about independent contractors or freelancers for income tax purposes. Filling out this form accurately can save time and money during tax season.

Contents

How to Fill Out a W-9 Form Printable

As an independent contractor, you must fill out a W-9 form periodically. While this tax document doesn’t need to be sent directly to the IRS, it can help determine your taxable income.

Filling out a Form W-9 online has never been simpler with our PDF editor tool. Whether you are creating one for yourself or a client, this convenient feature will save you time and energy.

How to fill out a W-9 form

This form is easy to fill out and should take no more than a few minutes to finish. It requires basic information like name, address, business name (if applicable), tax classification, and social security number.

Before filling out a W-9 form, consulting with a tax, financial, or legal expert may be beneficial. These professionals can ensure your form is filled out accurately, protects your rights, and meets employer expectations.

You can download a W-9 form from the IRS website or create one yourself. An online template creation tool such as pdf filler can save you a lot of time and typing by automating some steps.

Once your form is complete, be sure to sign and date it. Doing this helps verify that all information entered on the form is accurate and can be used when filing with the IRS.

Furthermore, you must enter your contact information on the form. This could include your email or phone number and mailing address. Moreover, provide the name and address of whoever requested your form.

Finally, you must indicate the type of entity you are. This could be an individual, corporation, limited liability company (LLC), partnership, trust/estate, etc. To fill in your tax status on the form, check the appropriate box and follow the instructions.

This document is commonly received from clients or companies that hire you to perform services. Keep a copy of all forms submitted to ensure a record for future reference.

To correctly complete a W-9 form, the IRS needs your name and address. They use this data to match up your 1099 form with tax filings for the year. Additionally, make sure you include your city, state, and ZIP code so they can properly match up the two records.

Who needs to fill out a W-9 form?

A W9 form is an IRS tax form that self-employed workers, freelancers, vendors, and independent contractors complete to report their income and tax information. It can be used for reporting income from various sources like gambling winnings, rents, and royalties, as well as dividends and interest income earned by these independent contractors.

The IRS also utilizes this form to report information for various purposes, such as non-employee compensation; real estate transactions; mortgage interest; acquisition or abandonment of secured property; cancellation of debt; and contributions to an IRA account. Utilizing a W-9 is essential for accurately recording your income.

If you need help completing a W-9 form, it’s best to seek professional assistance. They can guide you through the process and guarantee your form is filled out accurately and completely.

Begin by entering your name and TIN (your social security number or employer identification number for business entities). Then select which type of entity you’re operating under (i.e., sole proprietor or single-member LLC).

Finally, sign and date the form in the “Certification” field. Verifying that all information provided on this form is accurate is vital for successful completion.

The next section of the form requires you to choose your federal tax classification. If you’re filing as an individual, sole proprietor, or single-member limited liability company (LLC), you can select one of four options: C corporation; S corporation; partnership; and trust estate.

Consulting a tax accountant is recommended if you need help determining which option is best for your specific situation. They’ll assist in deciding the type of business entity that applies to you and offer guidance on filing taxes.

It’s essential to note that if you work as an independent contractor, you must make sure all tax withholdings are taken out of your income. To do this, complete a W-9 form each year and send it to the person or business that pays you. Moreover, send a 1099 form at year-end to the same company or individual who bore you.

What information is required on a W-9 form?

If you are a freelancer or independent contractor and asked to fill out a W-9 form, several pieces of information must be provided on the form. This includes your name, employer identification number (EIN), and tax identification number (TIN).

A Tax Identification Number (TIN) is a nine-digit number assigned to your business entity by the IRS that allows them to identify it. Providing the correct TIN on a W-9 form is critical since TINs must be provided for any entity filing an income tax return with the IRS.

You must enter your full legal name on the form’s first line. This should match what appears on your tax return and any business, trade name, disregarded entity, or DBA you own. Unless you own a single-member LLC or disregarded entity, include your Social Security number here.

Another line on the form asks you to confirm whether or not you are exempt from backup withholding. This means you may not have to pay federal income taxes to other businesses based on your payments. The IRS uses information provided on a W-9 form to calculate how much backup withholding should be applied to your costs.

Financial or legal professionals are the best resources if you need assistance filling out this form. They possess expert knowledge of tax law and regulations and can guarantee that the form is filled out accurately.

Finally, the third line of the form requires you to provide your address, city, state, and ZIP code. This is where your payee will mail your 1099. If you have recently moved or have a new address, include it here.

On the fourth line of the form, you must indicate whether your payee is exempt from backup withholding. The IRS only applies backup withholding to specific vendors, so ensuring this field is filled out accurately is critical for correctly filling out your tax return.

If you are still determining what should go on a W-9 form, it is recommended that you speak with either a financial or legal professional for guidance. An expert will have an in-depth knowledge of tax laws and regulations, which will enable them to ensure you fill out the form accurately and adhere to your employer’s expectations.

How to download a W-9 form

A W-9 form is a tax document that any self-employed individual must fill out and submit. The IRS requires this data to calculate taxes owed, while independent contractors, vendors, and freelancers can use it to avoid back withholding from their pay.

The initial part of the W-9 is your taxpayer identification number (TIN), which may be your Social Security Number or Employer Identification Number, depending on your business structure. TINs are free and can be obtained online or by phone through the Internal Revenue Service.

Next, enter your full legal name. Alternatively, you can include both your business and disregarded entity names. If the words do not match, fill out line 7 and check the box that reads “Also Use for a Different Account.”

In this section, you must enter your address – this should be the same one listed on your income tax return. Additionally, include your zip code and state.

Once you’ve entered all the necessary information, sign and date the form. Doing this carefully helps ensure that accurate data is provided – this could cause issues with payments or your tax return.

Self-employed contractors must ensure their W-9 form remains up to date. This includes submitting it whenever personal or business details change, such as when moving and receiving a new social security number.

This will guarantee your client or employer has a straightforward way to reach you if they have any queries about your work. Furthermore, it helps guard against any penalties related to payments or tax returns.

As an independent contractor, you must have your W-9 form downloaded and saved on your Mac for convenient access. Doing so will eliminate any worries of missing a deadline or providing incorrect tax identification numbers, which could result in future withholding taxes.

i need to send a W-9 to a company