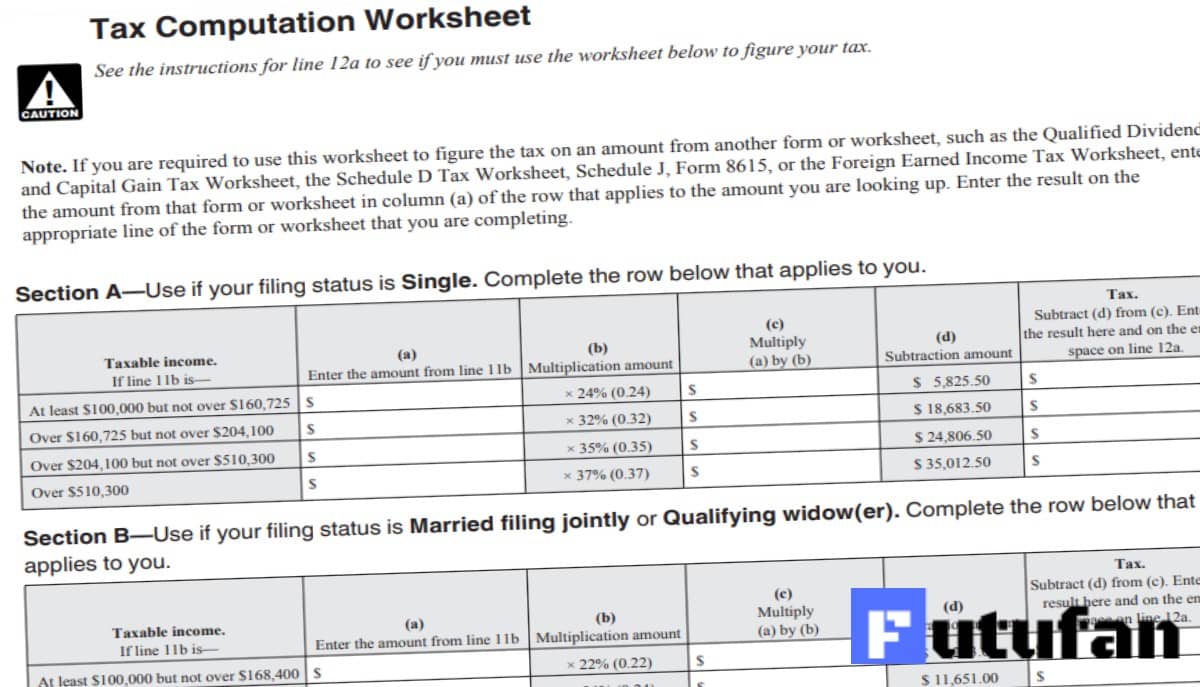

Tax Computation Worksheet for the 2023 taxes you’re paying in 2024 can be used to figure out taxes owed. The tax computation worksheet is for taxpayers with a net income of more than $100,000. Those with less than $100,000 in earnings can use the tax tables in order to figure out tax.

However, not everyone needs to use the tax computation worksheet or the tax tables. If any of the following applies, do not use the Tax Computation Worksheet 2023 - 2024.

- You are aged 18 by the end of 2023 and didn’t earn income that is more than half of your financial need.

- You are under the age of 18 at the end of 2023.

- Have more than $2,200 in unearned income such as dividends, other distribution, and interest.

- You are required to file a federal income tax return.

- You’re a full-time student between the ages of 19 and 24 and didn’t earn income that’s more than half of your financial need.

- One of your parents was alive at the end of 2023.

- You don’t file a joint return in 2023.

Who uses tax computation work sheet?

Use Tax Computation Worksheet 2023 – 2024 for Form 1040 you’re filing for 2023 taxes in 2024. For Form 1040 you’ll be filing in 2024 for the 2023 income you’ve earned, you may need to use the tax computation worksheet for the following.

To figure out the taxable portion of income entered on:

- Line 3a – Qualified Dividends and

- Line 3b – Ordinary Dividends.

- Line 7 – Other income from Schedule 1

If the amount on the lines above is less than $100,000, use the tax table. If more, use the tax computation worksheet.

Only those who need to figure out taxes on amounts that are over $100,000 needs to use Tax Computation Worksheet. The Tax Computation Worksheet works the same way as the tax tables. As long as you know the amount(s), you’re good to go.

Note: The IRS hasn’t published the 2023 Tax Computation Worksheet for Form 1040. As soon as the agency releases the Tax Computation Worksheet for 2023 taxes you’ll be filing in 2024, it will be added to here.