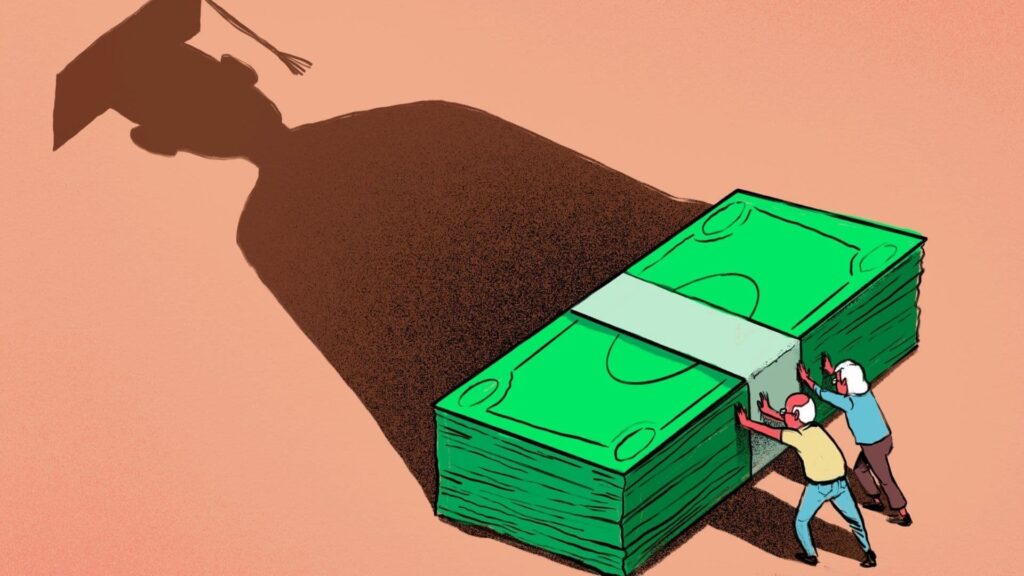

Parent PLUS Loans

Parent PLUS loans allow parents to borrow funds to bridge the gap between their child’s financial aid and the cost of attendance. They have a fixed interest rate and offer a variety of repayment options.

Parents who are currently carrying a Parent PLUS loan can slash their interest rates by refinancing with a private student lender. This will save them thousands in total interest costs and allow them to get their loans out of their name. It’s a great option for families that have accumulated a lot of debt for their children and want to get rid of it quickly. Unlike other federal student loans, PLUS loans require a credit check and have strict eligibility requirements. For example, in the past five years, parents can’t have an adverse credit history that includes a bankruptcy discharge, wage garnishment, foreclosure, repossession, or loan default.

The interest rate for a Parent PLUS loan is fixed at 5.30% and will remain that way for the life of the loan. The borrower must pay the interest as it accrues, but they can defer repayment for up to six months while their child is in school and during periods of deferment. This gives them some flexibility, but it’s important to remember that the unpaid interest will be capitalized into the principal of the loan.

Eligibility

Parents of dependent undergraduate students may be eligible to borrow Parent PLUS loans to cover educational costs not covered by other financial aid. They must meet federal and institutional eligibility requirements and complete the Free Application for Federal Student Aid (FAFSA). The Parent PLUS loan program does not have minimum credit score requirements. However, prospective borrowers must pass a credit check conducted by the U.S. Department of Education to be approved. In addition to interest, the federal government charges an origination fee. Unlike private parent loans, the federal Parent PLUS loan has flexible repayment options. Parents can choose from a standard, extended, or graduated repayment plan. Repayment typically begins as soon as the loan is disbursed, and parents can defer payment while their child is enrolled at least half-time.

Applicants who are denied a Parent PLUS loan because of an adverse credit history have the option to appeal the decision or get an endorser. An endorser is a person who has a positive credit history and agrees to repay the loan in the event of default.

Parent PLUS Loan Forgiveness

Parents who take out Parent PLUS loans to help pay for their child’s college education mean well, but they can often get in over their heads. The good news is that you can take steps to make repayment easier, including consolidating Parent PLUS loans, putting them in deferment, or even refinancing them into your name. However, be aware that student loan refinancing changes federal loans into private ones and does not qualify you for income-contingent repayment or loan forgiveness.

If you have a lot of Parent PLUS debt, consider consolidating your loans into a Direct Consolidation Loan. This will help you qualify for the Public Service Loan Forgiveness (PSLF) program, but it is important to keep in mind that only qualifying payments made on the consolidated loan count toward PSLF. In addition, you should be sure to document that you are working for a government agency or a non-profit.

Finally, be sure to check out your employer’s benefits package. More and more companies are offering tuition matching or other employee assistance programs, which can be a great way to settle your student loan balance quickly. Ultimately, it’s best to avoid counting on loan forgiveness because the reality is that it’s a crapshoot. Instead, focus on paying down your loan as quickly as possible. The debt snowball method is one of the most effective ways to do this.

Repayment Options

The standard repayment plan for Parent PLUS loans is a 10-year plan with fixed monthly payments. This is the default repayment option for Parent PLUS borrowers, but if you can’t afford your monthly payment under this plan, you can change to an income-driven repayment plan. To qualify for an income-driven repayment plan, you must first consolidate your Parent PLUS loans into a Direct Consolidation Loan. You can then choose to enroll in the ICR plan, which sets your monthly payment at 20% of your discretionary income or what you’d pay over 12 years on a fixed repayment plan – whichever is lower.

Another way to make your Parent PLUS loan payments more manageable is to refinance them with a private lender. Refinancing is an option available to borrowers with good credit, and it can reduce your interest rate or shorten the repayment term. Refinancing can also reduce your total debt, allowing you to easily reach your retirement goals.