IT-201 Instructions

Contents

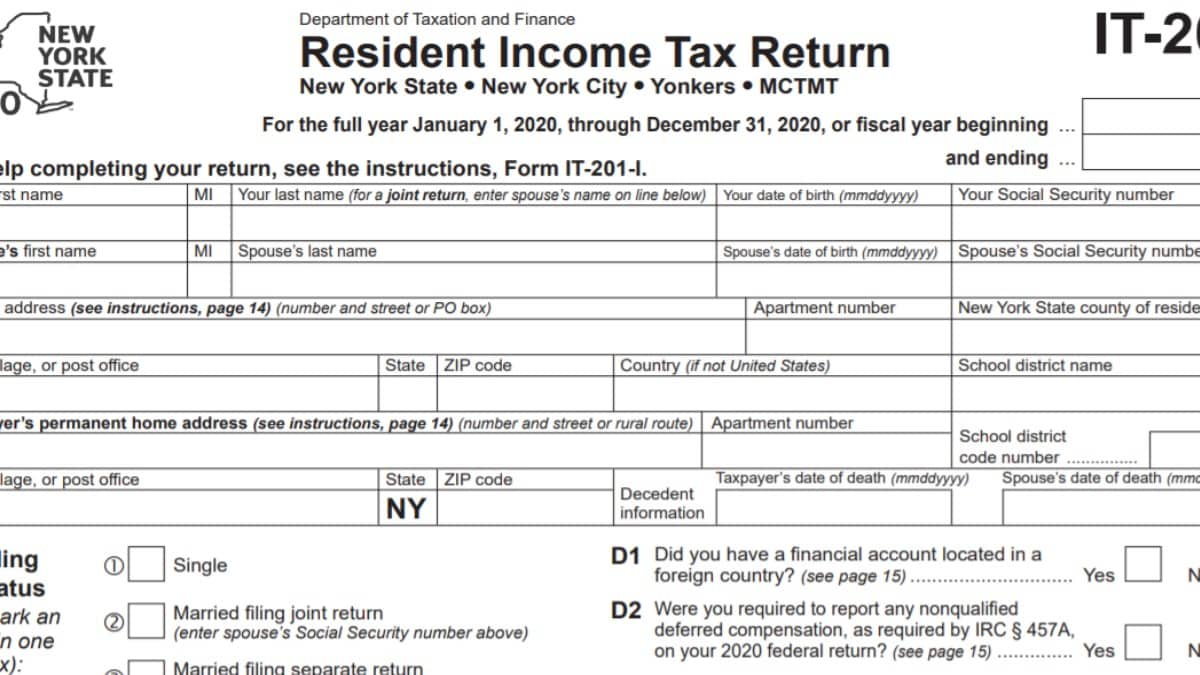

Form IT-201 is the state income tax return for New York residents. If lived or worked in the state and considered as a resident for tax purposes, taxpayers must file Form IT-201 to figure out and pay New York State income taxes. The deadline to file Form IT-201 and submit it to the state tax department has been extended for the 2023 – 2024 tax year. While you would have to file your return by April 15, you have until May 17 with the extended deadline. The same also goes for paying taxes.

To file Form IT-201 for free through free file, your income during the 2024 tax year must be less than $72,000. New York State Form IT-201 instructions to file is as follows for each four page of the NY state income tax return.

IT-201 First Page Instructions to File

Form IT-201’s first page details the personal information of the taxpayer such as name, contact information, address, filing status, and other tax provisions such as dependent information, whether you can be claimed as dependent or itemized deductions.

IT-201 Second Page Instructions to File

Report the state income tax paid through federal income tax withheld, New York additions and subtractions, and if you’re taking the standard deduction or itemizing deductions on the second page of IT-201. These overall will have a significant impact on your tax bill. Make sure to file this part correctly as you would have to amend the NY IT-201 in the future if errors were to be found.

IT-201 Third Page Instructions to File

The third page of Form IT-201 is where you’ll calculate tax liability, take out the portion of liability paid by credits, and computer NYC and Yonkers taxes, surcharges, and MCTMT. Many taxpayers have trouble with completing this section of the form. If you find yourself stuck somewhere, it’s best to consult a professional tax preparer.

IT-201 Fourth Page Instructions to File

The fourth and final page of Form IT-201 is the page where you will complete the NYC taxes, compute refund or tax bill, and give information on payment and refund. If you’re expecting a refund, make sure to request it direct deposit to your bank account so that it arrives the fastest.