IRS Tax Tables are used for figuring out taxes owed to enter on Form 1040, Line 12a. For the tax return you’re going to file in 2024 for the 2023 taxes owed, tax tables can be used to determine the taxes owed to the IRS.

If you’re new to filing taxes, the first thing that comes to mind is to do the math with the tax rate of your tax bracket. Since the tax bracket that applies to you doesn’t take that portion of your income, tax tables provide a better solution to finding out the taxes owed.

Who should use tax tables?

If your taxable income is less than $100,000, you can use the tax tables to find out how much you owe in taxes. Those with a taxable income of more than $100,000 needs to use the tax computation worksheets instead. See the tax computation worksheet from here.

Here is how to use the tax tables to find out how much you owe in taxes.

First and foremost, you need to find out your Adjusted Gross Income. Assuming you’ve already got there, take a look at the tax tables and see where your income lies in the tables.

You can find your taxable income on Form 1040, Line 11b.

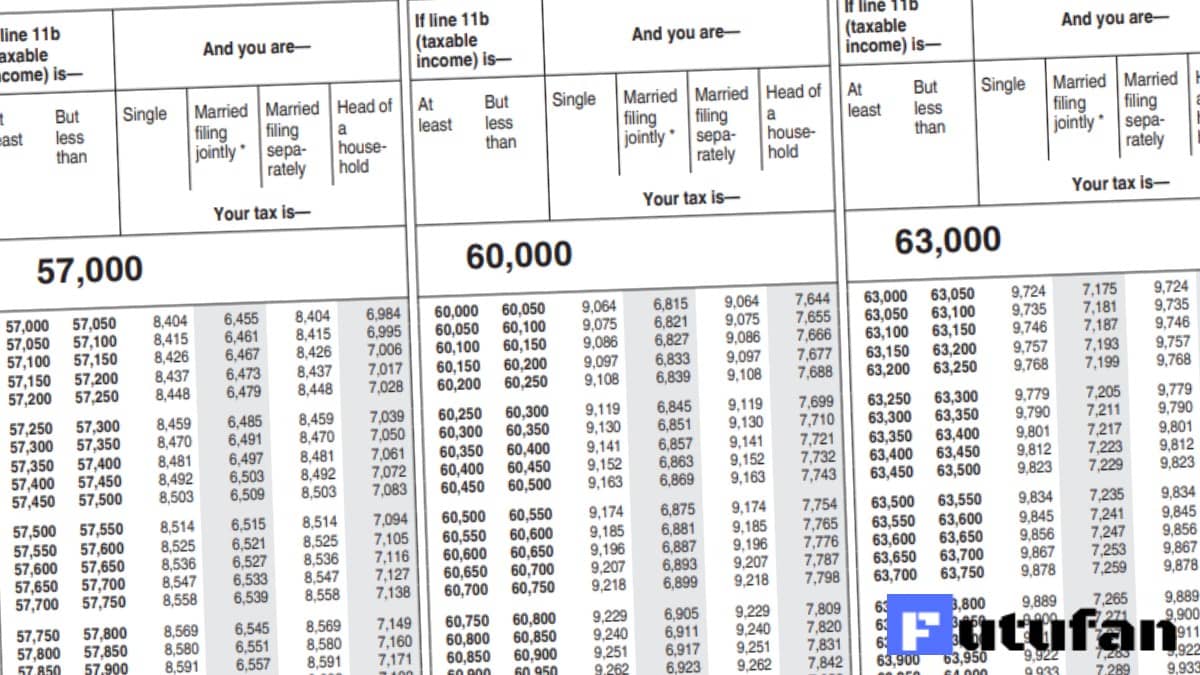

For example, if your taxable income is $60,540 and you’re single, you need to look at the appropriate tax tables. For the 2023 taxes you’re filing a return for in 2024, the single taxes owed is $9,174.

Example Image

As seen in the image taken from the tax tables above, the taxes owed is $9,174. Use the tax tables accordingly to figure out how much is owed in taxes.

Note: The IRS hasn’t released the tax tables for 2023 taxes you will be filing in 2024. Once the agency releases the tax tables, it will be attached to this articles.