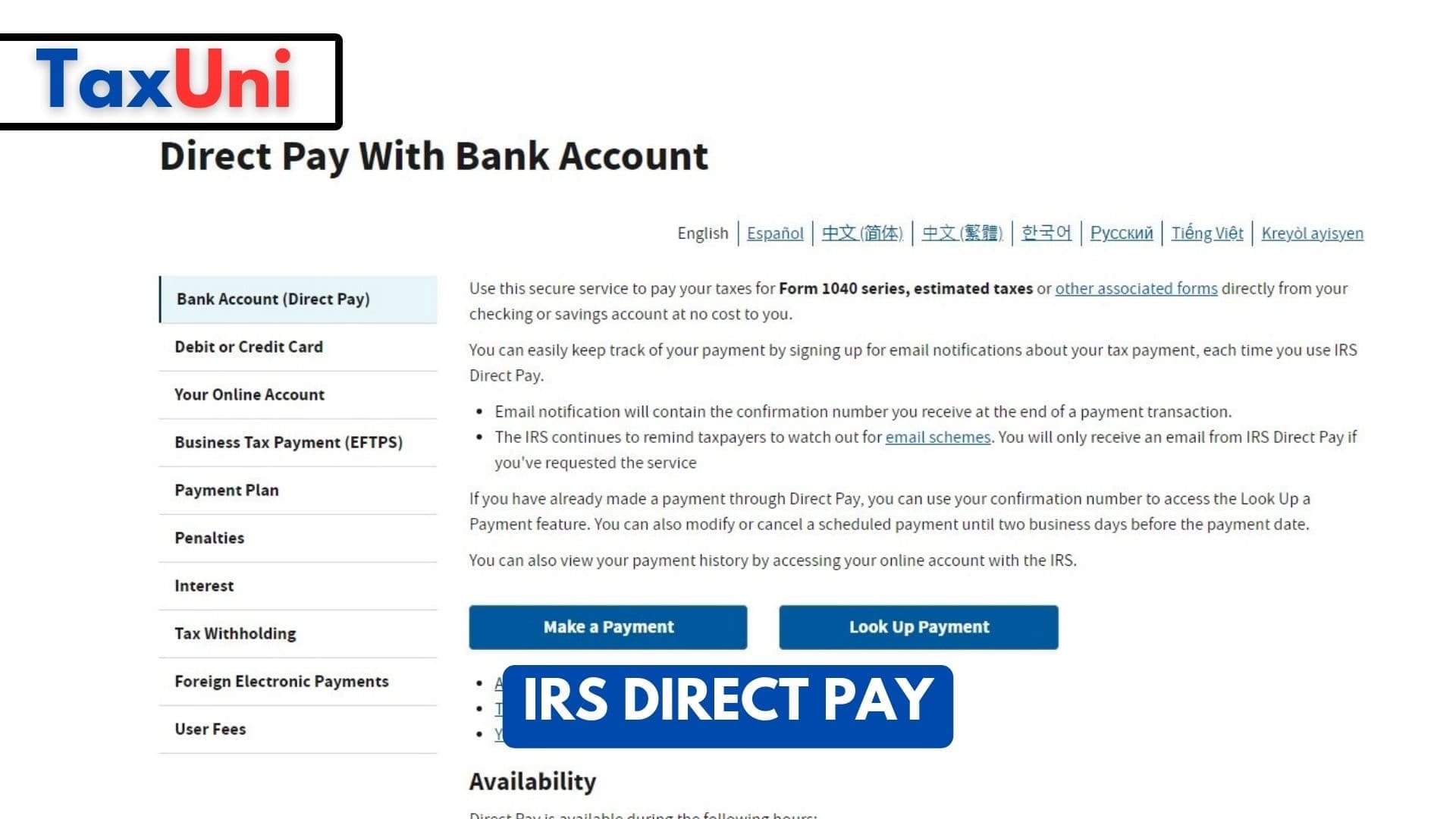

Using IRS Direct Pay is a simple way for individuals to pay individual taxes. Individuals can make payments online, 24/7, with a bank account (savings or checking), debit, or credit card. They can also receive instant email confirmation for their records. Individuals can even set up their payment to process within two business days. This service is available on the IRS website or through the mobile app IRS2Go. In either case, signing up and setting up a payment takes just a few minutes. You can also pay through a tax professional or an IRS retail partner. If you have a bank account, you can use Direct Pay to pay your taxes from your checking or savings account for free. You can even schedule payments up to 365 days in advance.

How to use IRS Direct Pay?

To use IRS Direct Pay, you need to have a valid account number and routing number for your bank. This is usually the bank account number for your personal checking or savings account, but it can also be a prepaid card’s routing and account number. To make a payment, simply enter your information on the IRS website and click “Submit.”

Using IRS Direct Pay is a straightforward process that requires only a few simple steps. To get started, taxpayers need to visit the IRS website (www.irs.gov) and search for “Direct Pay.” They will be directed to the Direct Pay page, where they can follow these steps:

- Taxpayers need to select the appropriate tax form or payment type from the available options. This could include income tax payments, estimated tax payments, extension payments, or other tax-related payments.

- Taxpayers will need to provide their personal information, including their name, address, and Social Security Number (SSN) or Employer Identification Number (EIN). They will also need to enter their bank account details, including the routing number and account number, to ensure the payment is processed accurately.

- To ensure the security of the payment process, the IRS requires taxpayers to verify their identity. This can be done by providing specific information from a prior-year tax return, such as their Adjusted Gross Income (AGI) or self-select PIN.

- Taxpayers can review the payment details for accuracy once all the necessary information is provided and verified. They should carefully double-check the payment amount and confirm that it matches their tax obligation. After verifying the payment details, taxpayers can submit the payment.

- Upon successful submission, the IRS Direct Pay system generates a confirmation number for the payment. It is crucial for taxpayers to save this confirmation number for future reference and record-keeping purposes.

Which Taxes Can Be Paid Via IRS Direct Pay?

- Individual taxpayers can use IRS Direct Pay to make payments for their annual income taxes. Whether they owe additional taxes or are making estimated tax payments, Direct Pay simplifies the process and allows for quick and secure transactions.

- Business owners, including sole proprietors, partnerships, and corporations, can use IRS Direct Pay to make tax payments related to their business income, payroll taxes, or other business-related tax liabilities.

- Taxpayers who have set up installment agreements with the IRS can conveniently make their monthly installment payments using Direct Pay. This ensures timely and hassle-free payment processing, avoiding any potential penalties or interest charges.

- For self-employed individuals or with other income sources not subject to withholding, IRS Direct Pay is an excellent option to make their estimated tax payments. This includes payments for federal income tax, self-employment tax, and additional Medicare tax.