Form 8949

You may be required to file Form 8949 if you have recently sold a large amount of property. You can either fill it out online or print it. Here's all you may want to know.

Contents

What is IRS Form 8949? IRS Form 8949 is used to report the sale of taxable investments. You may need to fill out this form if you are selling real estate, collectibles, or other assets. Brokerage companies are responsible for reporting such sales to the IRS. Different types of sales, like those of collectibles and real estate, may not be handled by brokerages.

Filling out forms can be stressful, so make sure to take your time and focus on the task at hand. Enter the information slowly, double-check your calculations, and re-read the form with fresh eyes. If you’re feeling particularly rushed, you can try using an online tool that will help you fill out the form quickly and accurately. These tools even let you add multimedia to the form.

Who can file Form 8949?

Form 8949 is required by the IRS after you sell a capital asset. This form is used by individual taxpayers when they sell stocks, bonds, equity options, and other capital assets. However, Form 8949 also needs to be filed with Form 1065 or Form 1120S.

Form 8949 should be completed when you sell a capital asset you’ve owned for the past two years. For most people, this form will include a description of the asset and the purchase and sale dates. You’ll also need to include the asset’s cost basis at fair market value, which is generally $20,000 plus $50 in transaction fees. The total profit or loss is therefore $9950.

How to fill out an 8949 Form?

In order to file Form 8949, you must have a number of pieces of information. Firstly, you should keep records of the dates and amounts of sales and purchases. Secondly, you should calculate your cost basis. For this, you can use third-party software. You can also complete Form 8949 online.

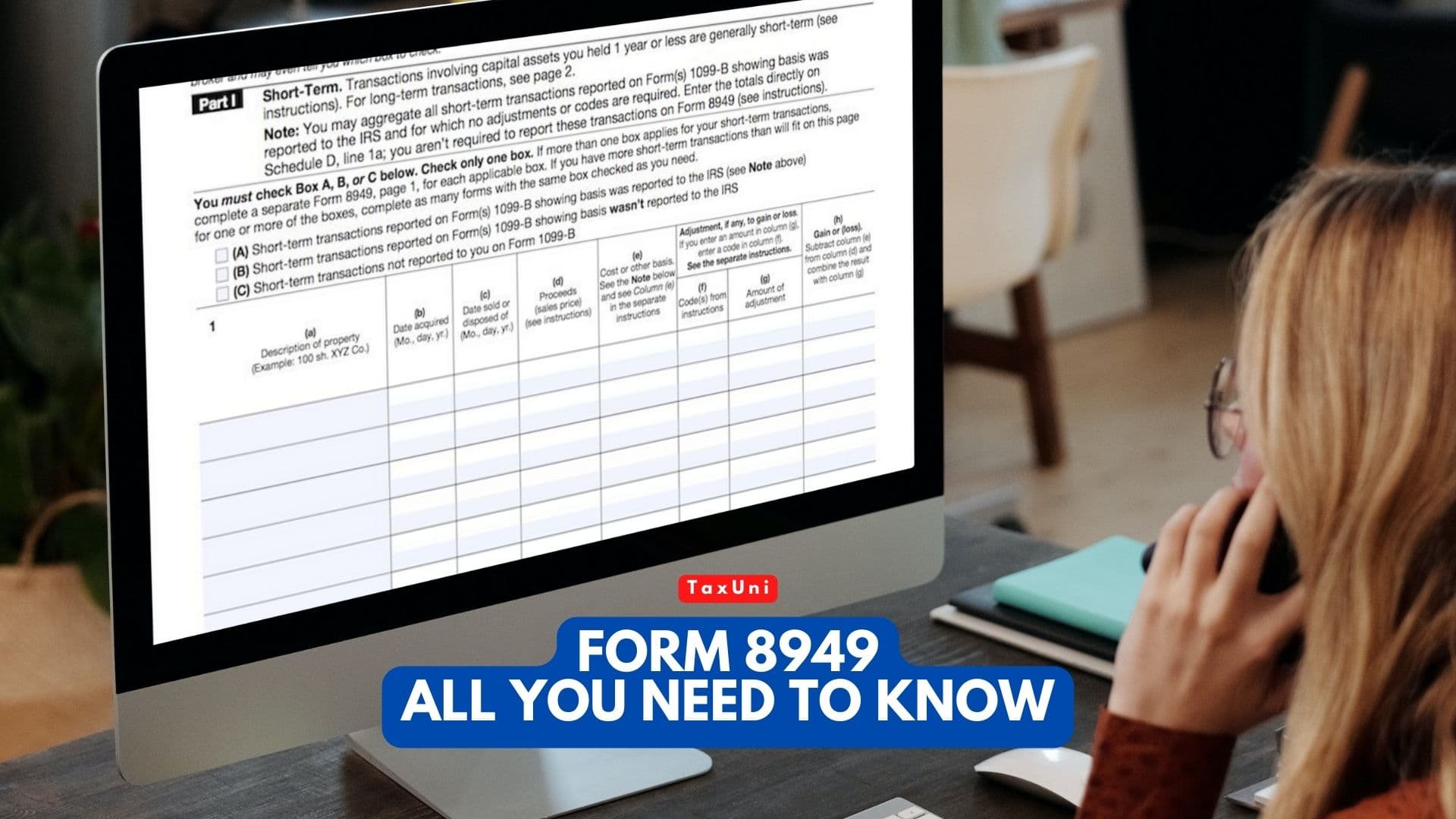

In addition, you need to have a taxpayer identification number. The form will have two parts: Part I and Part II. Part I will deal with short-term holding periods, while Part II will deal with long-term holding periods. If you received Form 1099-Bs, you need to file Form 8949 as well.

In addition to preparing Form 8949, you also need Form 8453. This will be included with your tax return. Then, you will attach your Form 8949 as a PDF. When you mail your Form 8949, make sure to include your Form 8453 with the document.

Make sure you choose the Part I reporting option and enter the details of your short-term capital asset transactions. This includes stocks, bonds, and real estate. If you make more than one capital asset transaction, you’ll need to fill out more than one Form 8949.

The form also requires you to report dispositions of qualified property. Some entities are exempt from reporting these transactions. However, you must report the amounts in column (g) on the form. You can find instructions for this in the instructions. You can also leave columns (f) and (g) blank if you don’t want to report certain transactions.

When Do I Need to Fill Out the 8949 Form?

By filling out the form, taxpayers can make sure they have reported their gains and losses correctly. This form is not an exact statement of taxable income, but it helps the IRS understand the types of trades you make.

You should include the original basis for the property in column (e) of Form 8949. Then, use column (f) of the form to list any net adjustments. Be sure to enter any negative amounts in parentheses. Also, remember to include any deductions or credits that you may have earned for the year.