Form 8621 Instructions

Form 8621, file it if you own shares of a Passive Foreign Investment Company (PFIC). Follow line by line 8621 instructions to file. Without a doubt, Form 8621—Information Return by a Shareholder of a Passive ForeignInvestment Company or Qualified Electing Fund is one of the hardest IRS tax forms to fill out. On average, it takes between 35 to 40 hours to file as the IRS estimates.

If you invest in a PFIC, it’s best to file Form 8621 with a tax professional rather than filing it yourself. Even tax professionals can have a hard time with filing Form 8621.

Deadline to File Form 8621

Whether you file it yourself or with a tax professional, it must be filed by June 15. Due to the COVID-19 crisis, the deadline to file Form 8621 along with all the other tax forms has been moved to July 15. If this isn’t enough for you to handle Form 8621 obligations, you can request an extension to October 15.

As for how much you are likely to pay a tax professional to do your 8621, you can expect to pay between $100 to $150 for up to 50 forms. This brings us to comparing paying for a tax professional with doing it on your own.

Considering it takes up to 50 hours to file Form 8621 for a non-tax professional, you will save plenty of time and lots of headaches in the way by letting a tax professional do your 8621. So, the $100 shouldn’t be a problem for taking away all the hurdles that come with Form 8621.

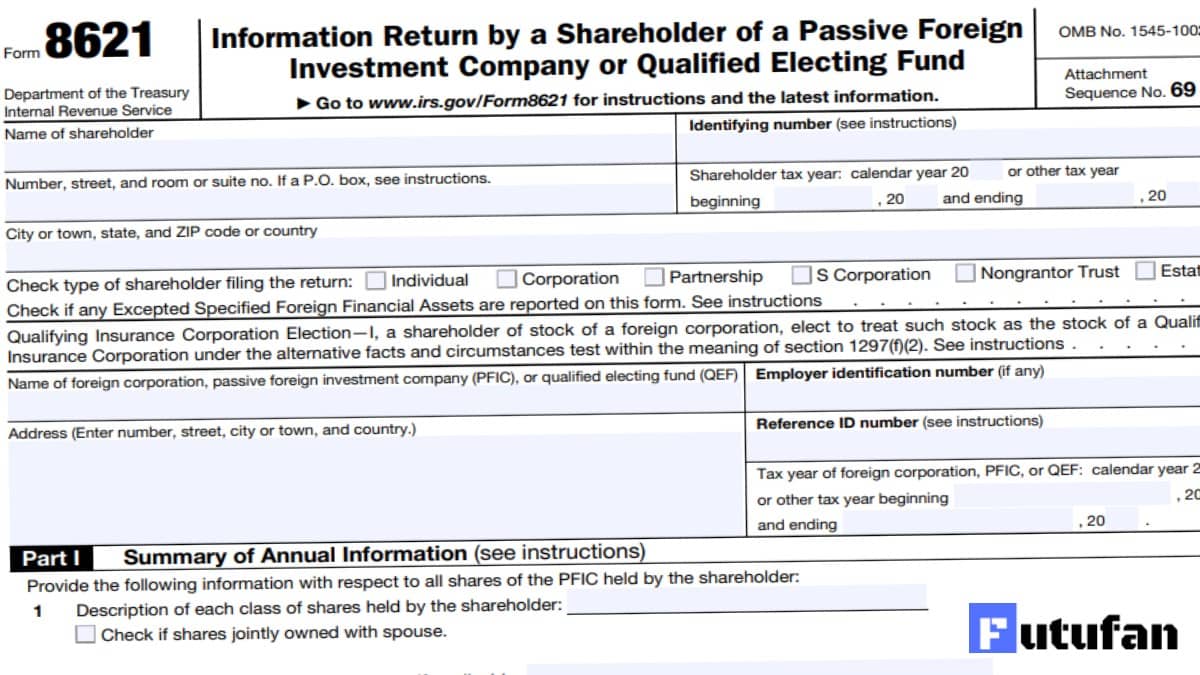

Form 8621 Instructions and Fillable PDF Form

Regardless though, those who want to fill out Form 8621 by themselves can do it so below.

Click the boxes to enter text, amounts, and dates.

Click here to preview the instructions to file Form 8621 or download it as PDF.