Form 1120S Instructions

There are many different uses for form 1120S, including preparing and submitting your tax return. If you are confused about the information required to file your return, read these form 1120S instructions to learn what the form is for and how to complete it. This tax form is used to report capital gains and losses from investments. You should use it only if you can demonstrate that you have received a profit from the investment.

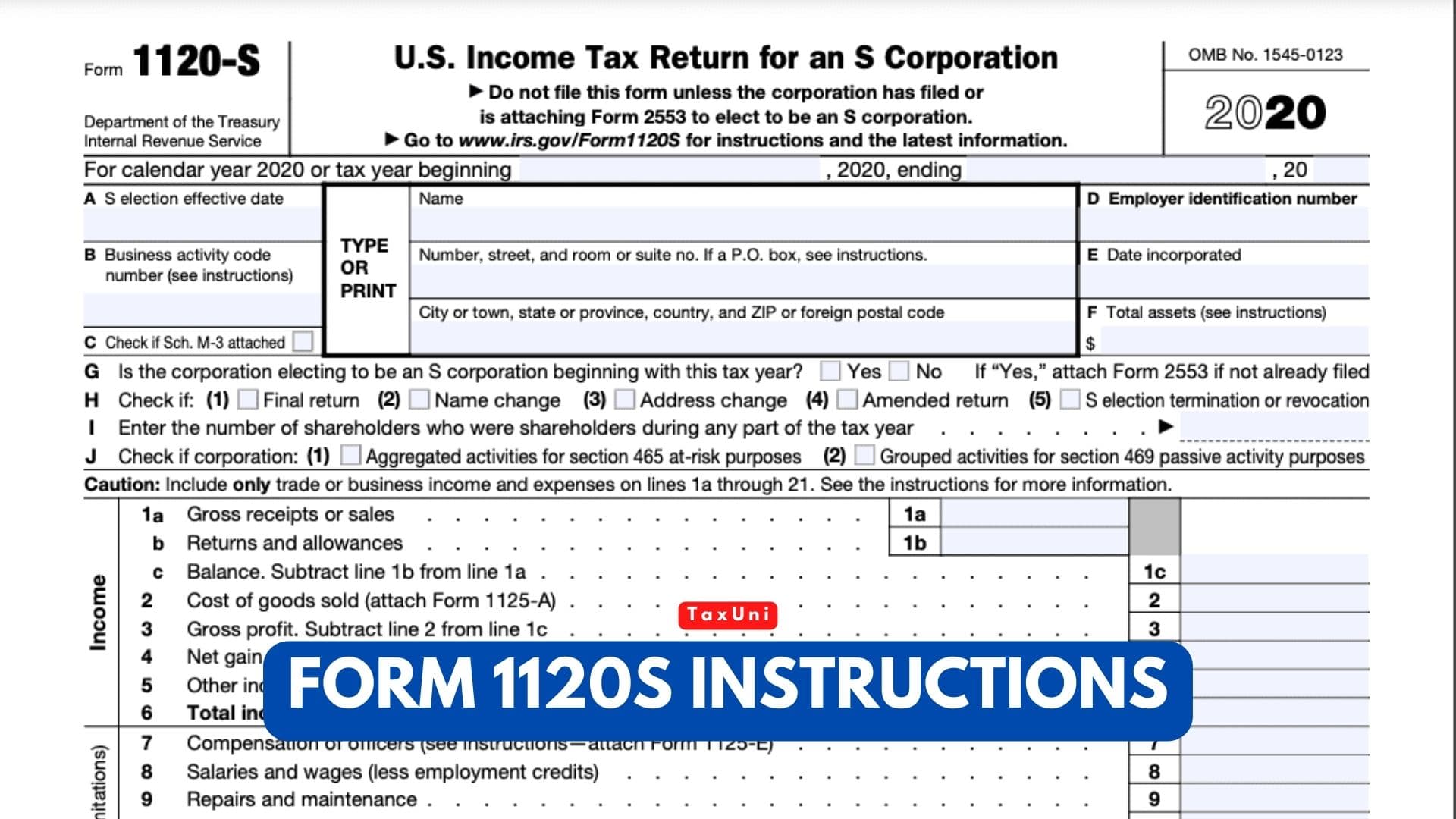

For the most part, filling form 1120S is fairly simple. It contains general information, income and deductions, and tax and payments sections. Schedules B, D, and K are required for all S-corps and must be completed. Schedules M-1 and M-2 are only required if your corporation generates over $250,000 in revenue. Other information is optional. 1120S form is designed to show your shareholders’ information and business activities.

S-corporations are taxed differently than regular businesses. Instead of paying regular corporation taxes, S-corporations can claim certain tax benefits. For example, S-corporations can deduct employee benefit programs like health insurance and group term life insurance as well as meals and lodging provided for employee convenience. S-corporations are also able to claim certain expenses for employee-related activities, such as phone service, postage, and travel.

A section of form 1120S devoted to reporting balance sheets from the books is called Schedule L. It follows basic accounting principles and reports balance sheets from the corporation’s books. The information contained in the balance sheet is from the books and not generated by the tax return. The IRS provides these instructions separately from the main 1120S instructions. When preparing this form, it is important to follow all instructions carefully. Make sure to ask for assistance from an accountant if needed.

How do I fill out a Form 1120S tax return?

Form 1120S contains information about trade or business activities of an S corporation. The income and expense section allows you to include deductible business expenses. Passive income, which is not tax-deductible, is not included in the total income. However, it may be deducted later on form 1120S. The Income section provides information on taxable interest, dividends, royalties, and capital gains.

The next section is called Schedule M-2. It includes the accumulated adjustments account and other adjustment accounts. It also includes the shareholder’s undistributed taxable income. To generate this schedule, choose it from the Main Menu of the 1120S tax return. Whether or not you made any adjustments, you can generate Schedule M-2 by selecting it from the Main Menu. When generating this schedule, enter the amount of each adjustment you have made.

If you’re unsure about the information needed to complete form 1120S, a qualified tax professional can help you. Oftentimes, tax professionals can help you convert information from source documents into IRS-acceptable information. Then, you can file form 1120S online or mail it to the IRS. The IRS has a list of approved private delivery services. You should check with a local accountant if you have questions about the tax return form.

Completing the Form 1120S: Step by Step

- Identification Information: This section includes the corporation’s name, EIN (Employer Identification Number), address, and other relevant identifying details.

- Income and Deductions: Here, corporations report their total income, deductions, and expenses. Various schedules and attachments may be necessary to provide detailed information.

- Shareholder Information: Details about each shareholder, including their name, address, ownership percentage, and any additional information required by the IRS.

- Tax Calculation and Payments: Corporations calculate their tax liability based on the reported income and deductions. Payments can be made along with the filing or can be scheduled for a later date.

- Additional Schedules and Attachments: Depending on the corporation’s financial activities, additional schedules might be required, such as Schedule K-1, which provides information about each shareholder’s share of income, deductions, and credits.