Florida Inheritance Taxes

Florida's Constitution safeguards residents and heirs from state taxes levied on the deceased's estate. This includes cash, IRA's, CD's, stock, life insurance policies, property, brokerage accounts, and businesses.

The state of Florida does not levy inheritance tax. However, if you inherit property in another state that does, the estate may be responsible for paying that state’s inheritance tax. Inheritance taxes vary by state, and are generally based on the relationship between the decedent and beneficiary. A married couple’s children and grandchildren are exempt from state inheritance taxes, but heirs who are non-family members may be liable for tax.

The federal government also imposes estate and gift taxes, so it’s important to consider these issues when making large gifts during your lifetime. These taxes can reduce your available estate tax exemption, so it’s important to consult with a professional before making any major gifts.

Moreover, the state of Florida doesn’t impose a separate inheritance tax, but it does require beneficiaries to pay income taxes on any money or property they receive from the estate. This is because inherited assets receive a “stepped-up” cost basis, which reduces capital gains tax liability when the beneficiary sells the asset. If a deceased individual fails to make a will, the state will decide how his or her property is distributed. This is a process known as escheat, and it can result in expensive legal fees for the beneficiaries.

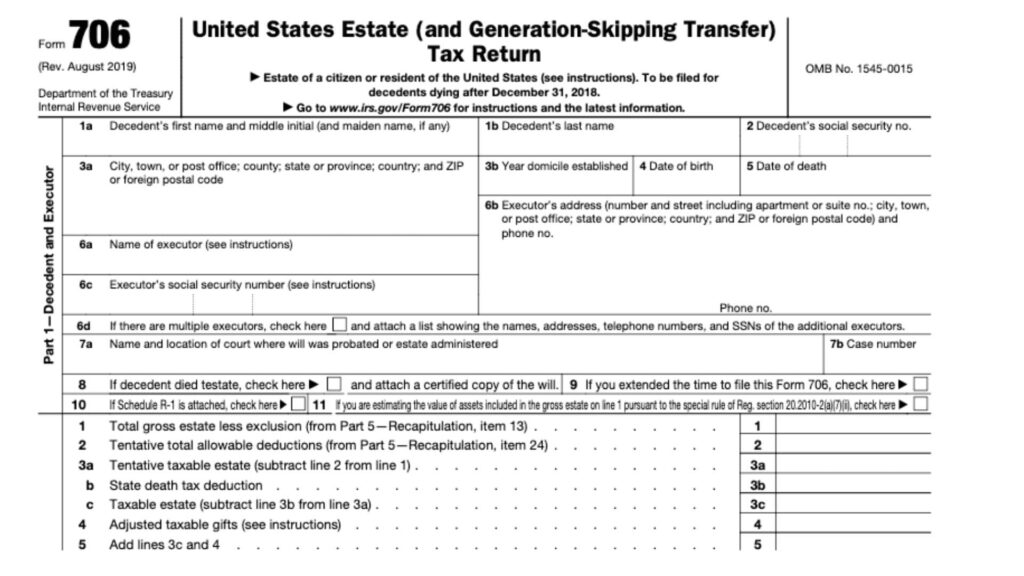

How to File Federal Form 706?

Florida does not have an inheritance or estate tax. The personal representative of a decedent’s estate must file federal Form 706 with the Internal Revenue Service within nine months after the date of death. A six-month extension is available.

The federal Form 706 requires the personal representative to provide a copy of the IRS closing letter, including the credit for state death taxes and prior transfers. Florida’s “pick-up” tax system is designed to match the federal credit, reducing or eliminating the need for a separate state inheritance tax.

Florida residents can avoid this tax by including Florida as a primary beneficiary on their federal estate plan, or by taking steps to ensure that their out-of-state assets are properly titled and managed in order to take advantage of the Florida exemptions. Our firm’s estate planning lawyers can help families develop a comprehensive strategy that takes full advantage of the law and minimizes estate and gift taxes.