Federal Tax Brackets 2022

Contents

The Internal Revenue Service adjusts the federal income tax brackets every year against inflation and changes to the cost of living. The US inflation rate is expected to be a little higher than the last decade’s average, which is about 1.8 percent.

A higher inflation rate could affect the tax brackets where the amount for each bracket is increased, yet the tax rates remain the same. For example, the 10 percent tax bracket applies to income up to $9,950 for single filers in 2021 tax brackets, whereas it was $9,700 for 2020. This difference is going to be higher for the 2022 tax season as the inflation is higher and more visible as the Department of Labor announced the Consumer Price index is the highest since 2008.

Updated Tax Brackets

The Internal Revenue Service announces the new brackets by the start of the following tax year. As of August 2021, the new brackets are still a few months away, but there are important developments for the US tax code that you might want to know.

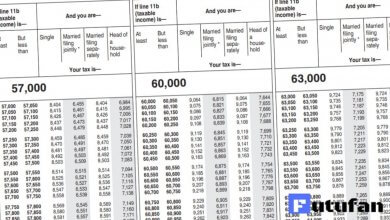

| Tax Rate | Single | Married Filing Jointly | Heads of Households |

|---|---|---|---|

| 10% | $0 to $10,275 | $0 to $20,550 | $0 to $14,650 |

| 12% | $10,275 to $41,775 | $20,550 to $83,550 | $14,650 to $55,900 |

| 22% | $41,775 to $89,075 | $83,550 to $178,150 | $55,900 to $89,050 |

| 24% | $89,075 to $170,050 | $178,150 to $340,100 | $89,050 to $170,050 |

| 32% | $170,050 to $215,950 | $340,100 to $431,900 | $170,050 to $215,950 |

| 35% | $215,950 to $539,900 | $431,900 to $647,850 | $215,950 to $539,900 |

| 37% | $539,900 or more | $647,850 or more | $539,900 or more |

Increased marginal tax rates 2022

Since 1993, there hasn’t been a tax hike in the United States. Biden administration is working on a tax hike that would increase taxes on individuals and married couples filing a joint return that earns more than half a million a year. The taxable income amounts in the tax brackets will remain pretty much the same, but the top 37 percent tax rate will be replaced by a new rate, rising to 39.6 percent. This is a tax hike of 2.6 percent that affects top individuals.

There are also tax increases for corporations that are making a significant amount.

Frequently asked questions about federal tax brackets

How many tax brackets are there?

There are a total of seven tax brackets, thus, seven different tax rates that apply to taxpayers. The marginal tax rates start from 10 percent and go up to 37 percent (subject to change in 2022). In between, you can pay 12 percent, 22 percent, 24 percent, 32 percent, and 35 percent of your taxable earnings in federal income taxes.

How do tax brackets work?

The way tax brackets work confuses taxpayers at first, but it’s easy when you think about them as buckets you fill in before moving to the next one rather than something that takes away a portion of your income. For example, if your taxable income is $100,000, the highest tax rate that applies to you is 24 percent, but only for income earned over that exceeds the 22 percent tax bracket. According to the current tax brackets, you’ll pay 10 percent of your taxable income up to $9,950, then 12 percent of taxable income up to $40,525, and so on. The highest rate only applies to income earned that places you in the final bracket according to your taxable income.

Are tax brackets after deductions?

In a way, tax bracket amounts are after deductions. The Internal Revenue Service has multiple ways to measure a taxpayer’s income. You first fill out Schedule 1 to figure out adjusted gross income. Then, take out deductions to calculate taxable income. You’ll pay taxes based on your taxable income, not the total income earned during the tax year. Learn more about adjusted gross income and modified adjusted gross income.

Will tax brackets change in 2022?

The tax brackets are renewed every year by the Internal Revenue Service. Because the IRS wants to ensure that everyone pays pretty much the same portion of their income in taxes every year, inflation and changes to the cost of living adjustments are made. The reason for the changes is not necessarily to increase taxes but to ensure taxpayers are paying the same amount as in value towards taxes.

Will I pay more tax in 2022?

There is a high chance that you’ll pay a higher tax bill in 2022, BUT, only if you’re a top-earning individual or couple. If your taxable income exceeds over $500,000, you’re likely to pay 2.7 percent more in taxes, as stated above, because of the anticipated tax hike.

Increased marginal tax rates 2022

Since 1993, there hasn’t been a tax hike in the United States. Biden administration is working on a tax hike that would increase taxes on individuals and married couples filing a joint return that earns more than half a million a year. The taxable income amounts in the tax brackets will remain pretty much the same, but the top 37 percent tax rate will be replaced by a new rate, rising to 39.6 percent. This is a tax hike of 2.6 percent that affects top individuals.

Above seems incorrect … if you go from 37 to 39.6 isn’t that a 7.03% increase ?

2.6 divided by 37 = 7.03% ?

37 x 1.0703 = 39.60 ?

Please help me understand how I’m incorrect … thank you kindly …