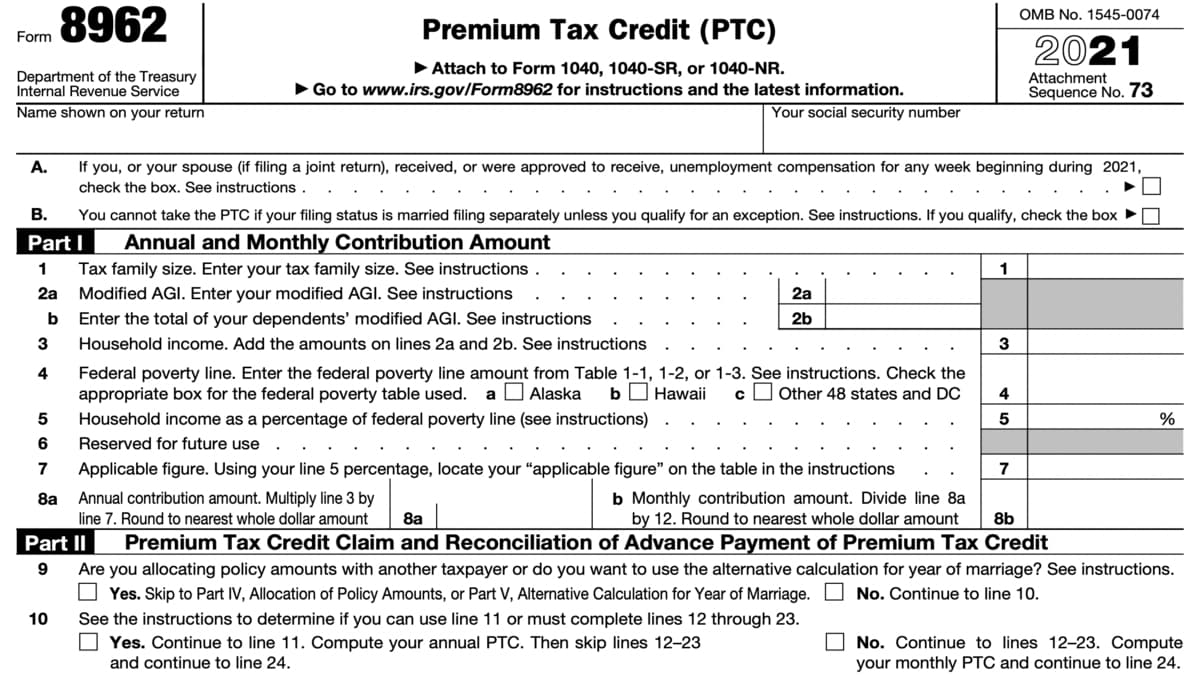

Form 8962, Premium Tax Credit is the tax form you will use to calculate your credit amount and figure out whether or not you need to make payments to cover the excess received in advanced payments. A good portion of taxpayers that purchased health insurance through the federal health insurance marketplace or their state exchange are eligible for the premium tax credit. Use Form 8962 and attach it to your federal income tax return to claim the credit.

Fill out Form 8962

Start filling out Form 8962 from below. This version of Form 8962 is fillable online for the 2023 – 2024 tax season and suitable for taxpayers that are filing a paper tax return.

The above Form 8962 doesn’t replace e-filing and you will need to print out a paper copy and file your federal income tax return on paper as well. You can then attach Form 8962 to your return and mail it to the Internal Revenue Service along with other tax forms and documents.

Adjust advanced payments

If you received advanced payments of the premium tax credit, there is a chance that you received more or less than what you’re eligible to claim. In these cases, Form 8962 also helps you adjust the total amount received during the tax year as you fill it out to calculate the credit amount.

Content of Form 8962

Form 8962 is made up of three separate parts. These are as follows.

- Annual and monthly contribution amount

- Answer questions about your family size, household income, and proportion of it to the federal poverty line.

- Premium tax credit claim and reconciliation of advance payment of PTC

- Calculate how much you’re eligible to claim and compare it with the advanced payments received during the tax year and compare the two. You will then calculate whether you received more or less than what you can claim and get more in the credit or repay the excess.

- Repayment of excess advance payment of the PTC

- If you received more than you can claim in advanced payments, calculate how much you need to repay and subtract this amount from the total taxes paid or your refund for accurate calculations.

- Allocation of policy amounts

- Enter up to four policy amount allocations, Social Security Number of the taxpayer, allocation start and end month, premium percentage, SLCSP, and advanced payment of the credit percentage.

- Alternative calculation for year of marriage

- If you’re electing the alternative calculation for year of marriage, complete this part following the instructions for Line 9 on Premium tax credit claim and reconciliation of advance payment of PTC (second part).

Form 8962 mailing address

Many taxpayers wonder about the mailing address for Form 8962 for some reason. There isn’t a separate mailing address for Form 8962. You will file it and attach it to your 1040 and mail your tax return to the IRS processing center. Learn more about mailing addresses for tax returns.