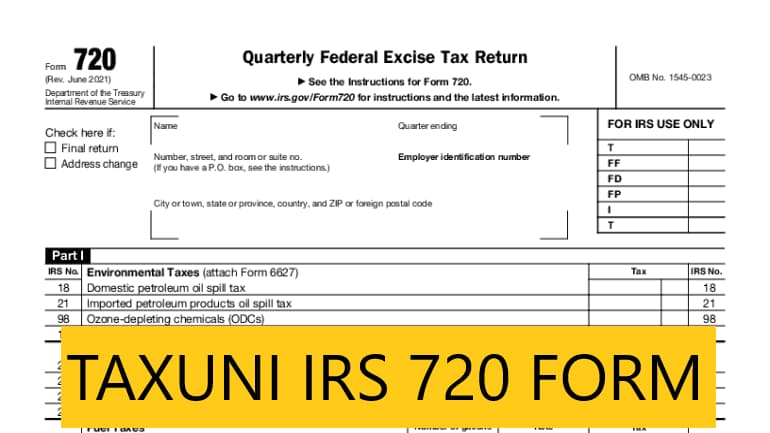

720 Form

Contents

You may be wondering how to fill the 720 Form out and what you are supposed to do if you aren’t sure about how to fill it out. This article will provide you with an overview of what is required. Once you have understood the instructions, you can move on to the next step. In addition to filling out the required fields, you’ll also need to fill out the correct schedules to avoid any possible mistakes.

How to fill out 720 Form?

You must complete Schedule T and Schedule C in order to complete your IRS 720 Form. Schedule T contains information on the amount of taxable fuel you use. This information is necessary to calculate the amount of tax you owe.

You must file the 720 Form within one month after the end of each calendar quarter. If you’re unsure about what to do, you can consult your tax software or bookkeeping software for guidance. It only takes a few minutes each quarter, but if you are late filing, you’ll be subject to penalties similar to those for non-filing your income tax return or late payment. Keep in mind that penalties for late filing are based on the amount of taxes you owe.

Please note that filing forms late is a common mistake resulting in penalties and additional expenses. As a result, it is essential to make copies of your completed 720 Form.

Can you file Form 720 annually?

Unfortunately, you cannot fill out the 720 Form annually. It is possible to fill out this form every three months. If a quarter ends on March 31, you’ll need to file the Form on April 30. If you can’t pay the entire amount in a month, you can defer the payment until you’ve accrued enough tax liability. This allows you time to pay your taxes before the deadline.

Who must file IRS Form 720?

If you’re selling excisable goods or services, your business must complete IRS Form 720. You are under no obligation to complete this form unless you provide services in one of the areas listed below:

- telephone communications

- air transport

- petrol

- cruise ship transports

- coal

- fishing equipment

- bows and arrows

- tires

- vaccines

Can you file Form 720 electronically?

You can also e-file your Form 720 if you’re making payments online. This is an option that is beneficial to those who don’t want to wait for their tax refund to be processed.

Your sponsor must submit through an approved transmitter software developer to file Form 720 electronically. A copy of the instructions is also acceptable. You can submit the forms by mail if you prefer. You can also print them out and mail them to the IRS.