1099-NEC Form

Contents

Form 1099 NEC, Nonemployee Compensation is the tax form for reporting income paid to nonemployees by a business. While income paid to an employee is reported using Form W-2, 1099-NEC must be filed to report income paid to freelancers and independent contractors.

Let’s say you hired an independent contractor to paint your office space. The payments made to the contractor must be reported using Form 1099NEC. The Internal Revenue Service makes it mandatory to use these information returns for payments that exceed $600 during the tax year. Because the contractor/freelancer won’t have the necessary tax forms to report the income earned from this, the person hired rely on the payer to receive it.

The deadline to file Form 1099-NEC is the same as the majority of other 1099s – January 31st. There is also Form 1096 that reports the Forms 1099 filed during the tax year to the Internal Revenue Service. If you’ve filed Forms 1099 on paper, you aren’t required to mail them using Form 1096. You can simply file Form 1099 NEC on paper and 1096 electronically. The deadline to transmit these tax forms to the Internal Revenue Service is March 31st for e-filers and February 28th for mailed-in information returns.

1099-NEC Fillable Online

Form 1099-NEC is fillable online using our TaxUni PDF Filer. You can enter all the information you need on the form such as personal information, money amounts, and check the boxes that are necessary. Head over to the 2024 Form 1099-NEC PDF filer and start filling out the forms.

First time filing Form 1099-NEC? Read the instructions to file Form 1099-NEC 2023 - 2024.

After filling out a copy of 1099-NEC, you can save it as a PDF file on your device and furnish the recipients by email. As what’s needed on Form 1099-NEC is very limited, it shouldn’t take you more than five minutes to complete a copy – as long as you have access to the monetary amounts and the recipient’s information. Don’t have the recipient’s TIN? Request his or her Taxpayer Identification Number using Form W-9 for the 2024 tax season.

2024 Form 1099-NEC Printable

Form 1099-NEC is also printable through TaxUni PDF filer. Just enter everything that’s needed and print out a paper copy right away. You don’t even need to save it as a PDF to your device, but we highly suggest keeping electronic copies as a backup to the original paper documents filed in case they ever get damaged or lost.

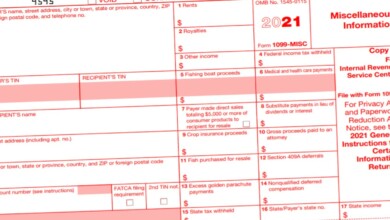

Do I file Form 1099 MISC or 1099 NEC?

Both forms can be used for the same purpose. So, you can fill out either one of them, but to make ease the tax obligations – you might want to fill out Form 1099-MISC rather than 1099-NEC. Because you will need to file Form 1096 for every type of 1099 you file, file Form 1099-MISC if you’re filing it form for other purposes, such as rents, healthcare payments, and attorney payments. This overall will make you not file an additional Form 1096. Nevertheless, you can use either one of these two forms without any problems.

How many copies of Form 1099-NEC are needed?

There are four different copies of Form 1099-NEC that you need to file. One with the Internal Revenue Service that you’ll attach to Form 1096, for the recipient, for you, and another one for the state tax department. Note that you don’t need a separate tax form to send a 1099-NEC to the state tax department as you do with the IRS. There is also another copy of Form 1099-NEC that needs to be filed for the state income tax return of the recipient.