Contents

What is 1099-MISC Form?

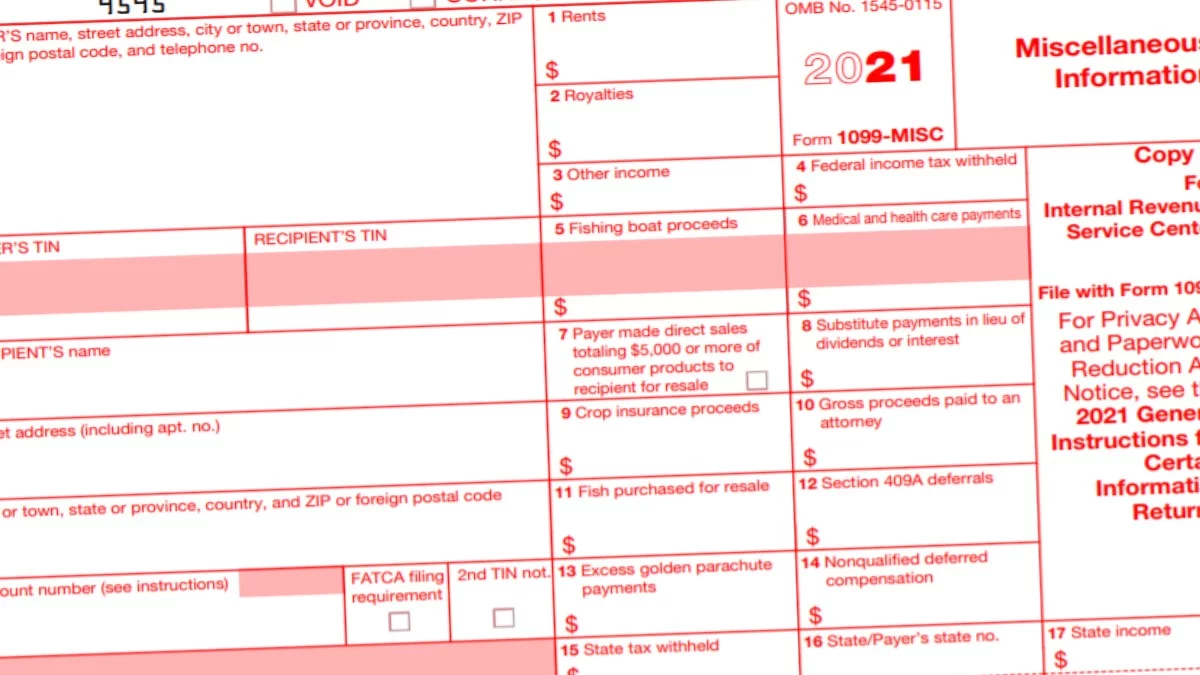

The 1099-MISC form is a crucial document used in the United States to report various types of income, particularly income earned by independent contractors, freelancers, and self-employed individuals. This form serves the purpose of facilitating tax compliance by tracking and collecting taxes on income that may not be subject to regular payroll withholding.

Who is required to file 1099-MISC?

Businesses and individuals who make payments of $600 or more for services, rents, or other nonemployee compensation to individuals or businesses are typically required to file a 1099-MISC. This form is primarily used to report income earned by independent contractors and other nonemployees.

What information must be included on a 1099-MISC?

The 1099-MISC form requires several pieces of information to be included, which are summarized in the following table:

| Box Number | Information to Include |

|---|---|

| Box 1 | Nonemployee Compensation |

| Box 7 | Miscellaneous Income |

| Box 15 | State Tax Withheld |

| Box 16 | State/Payer’s State No. |

| Other Boxes | Vary Depending on Income Type |

How to file a 1099-MISC?

Filing a 1099-MISC involves several essential steps, as outlined below:

- Collect Information: Gather all the necessary information, including the recipient’s name, address, and taxpayer identification number (TIN).

- Obtain a W-9 Form: Before making payments, request a completed Form W-9 from the recipient. This form provides their TIN and verifies their legal status. Keep a record of the W-9 for your files.

- Fill Out the Form: Complete the 1099-MISC form, including the payer and recipient’s information, payment details, and any withheld taxes.

- Submit Copies: Send Copy A to the IRS, Copy 1 to the state tax agency (if applicable), and Copy B to the recipient. Keep Copy C for your records.

- Deadlines: Ensure that you file the 1099-MISC forms by the designated deadlines. These deadlines may vary each year, so check with the IRS for the specific due dates.

- Electronic Filing: Consider electronic filing, especially if you have a large number of forms to submit. The IRS provides online resources for e-filing.

What are the penalties for not filing a 1099-MISC?

Failing to file a 1099-MISC or filing incorrect information can result in penalties. Penalties may vary depending on the degree of lateness or negligence. The following table outlines potential penalties:

| Violation | Penalty |

|---|---|

| Failure to file a correct return | $50 to $280 per form |

| Intentional disregard of filing | Minimum $560 per form or higher |

| requirements | |

| Filing within 30 days of due date | $50 per form |

| After 30 days but by August 1 | $110 per form |

| After August 1 or not at all | $280 per form |

Therefore, it’s crucial to meet the filing deadlines and ensure accurate information on the forms to avoid penalties and legal issues. The IRS enforces these penalties to encourage compliance and timely reporting of income.

1099-MISC vs. 1099-NEC Comparison

Here is a comparison table highlighting the key differences between the 1099-MISC and 1099-NEC forms:

| Aspect | 1099-MISC | 1099-NEC (Nonemployee Compensation) |

|---|---|---|

| Purpose | Used for various types of income, such as rents, royalties, and other miscellaneous income, in addition to nonemployee compensation. | Specifically designed for reporting nonemployee compensation. |

| Filing Deadline | Prior to tax year [year1], nonemployee compensation was reported on the 1099-MISC. However, starting in tax year 2024, nonemployee compensation is reported on the 1099-NEC. | As of tax year 2024, nonemployee compensation is reported on the 1099-NEC. |

| Nonemployee Compensation | Typically found in Box 7. | Entire form is dedicated to reporting nonemployee compensation. |

| Miscellaneous Income | Various types of income, like rents, royalties, and other payments, are reported in different boxes, including Box 1 and Box 3. | Specifically focused on nonemployee compensation, so other types of income are not included. |

| State Taxes Withheld | Box 15 is used for reporting state tax withheld. | Similar to the 1099-MISC, Box 15 can be used to report state tax withheld. |

| Additional Information | May require information in other boxes depending on the type of income being reported. | Primarily focused on the recipient’s nonemployee compensation, so there are fewer additional boxes for different types of income. |

| Filing Threshold | Payments of $600 or more for services, rents, or other nonemployee compensation must be reported. | Nonemployee compensation of $600 or more must be reported. |

In summary, the 1099-MISC and 1099-NEC forms serve distinct purposes, with the primary difference being the specific focus of the 1099-NEC on reporting nonemployee compensation, while the 1099-MISC includes a broader range of income types. The IRS introduced the 1099-NEC to streamline the reporting of nonemployee compensation, starting in tax year 2024.