1096 Form

Contents

One of the most common information returns for small businesses is Forms 1099. The Internal Revenue Service requires these information returns regardless of the type of 1099 to be transmitted to the agency using Form 1096. This is what tells the IRS here is I paid these people this much. It’s mandatory to file, and there is a heft penalty that comes with it if you ignore or file it later than you’re supposed to.

Though the idea of submitting Forms 1099 to the Internal Revenue Service may sound like a lot of work considering the number of forms filed every year, it doesn’t take that much effort. Here is everything you need to know about filing Form 1096 in 2024 to report payments made that are reportable on Forms 1099.

Who files Form 1099?

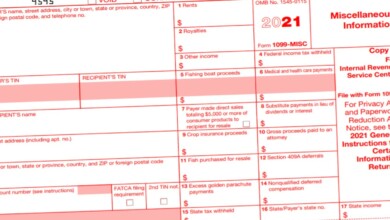

Form 1099 is the mandatory information return that reports transactions for a series of types of payments. You can learn more about the use of Form 1099 from here.

Assume you made a payment to a contractor to paint the walls in your worksite. Since the contractor is not an employer and self-employed, it’s your responsibility – the payer – to report the income payments made. This is done using Form 1099-NEC or 1099-MISC. Other than these two types of Form 1099, there are numerous ones that report different income payments like interest payments, dividends, certain government payments, to name a few.

If you file even a single Form 1099 or other information returns that are required to be submitted with 1096, you must file it.

How to file Form 1096?

As briefly mentioned, Form 1096 isn’t just filed for the 1099s. You’re also required to file this tax form for the following information returns.

The way Form 1096 is filed quite simple. You take the relevant tax forms, separating each type of form that you filed that you will submit through 1096, and file a single document. For example, a single Form 1096 for every 1099s you filed and a single Form 1096 for the 3921s you filed, and so on. You aren’t required to file Form 1096 for every information return filed.

Form 1096 PDF

Form 1096 PDF presented by the Internal Revenue Service isn’t scannable; thus, you can’t file it to submit it. You must use the official document. You can get the required tax forms, including Form 1096, by ordering them via call. The Internal Revenue Service does a phenomenal job at sending the necessary documents to taxpayers so that they can fulfill their tax obligations.

The last day to file

Form 1096 is due on February 28, 2024, for the 2023 taxes. You must fill and submit Form 1096 to the Internal Revenue Service by the above deadline, or you will have to pay late-filing penalties. Wilfully ignoring to file Form 1096 can even result in fines up to $500 per violation. Make sure to prepare these documents before the tax season ends so you’re clear to submit them to the Internal Revenue Service.

Since a hefty penalty comes with filing form later, we recommend finishing up the information returns at hand and furnishing contractors and other relevant individuals/businesses, then getting ready to file Form 1096.

FAQs

Can I file form 1096 electronically?

Form 1096 can be filed electronically through any tax preparation software. You can easily stack up the information returns and submit them to the Internal Revenue Service. One thing to keep in mind about e-filing Forms 1096 is that it’s mandatory if you’re sending more than 250 information returns with the form.

Can Form 1096 be handwritten?

File Form 1096 by hand with no problems. As long as handwriting is readable, there is nothing to stress about it. You can simply get the official document and file it with a pencil.

Who needs to sign Form 1096?

The person who’s filing the 1096 or the registered tax preparer needs to sign form 1096. If you’re not clear who’s supposed to sign it, make sure that the person who signs 1096 can’t be different than the name on the payer section of information returns unless a tax preparer files it.