Contents

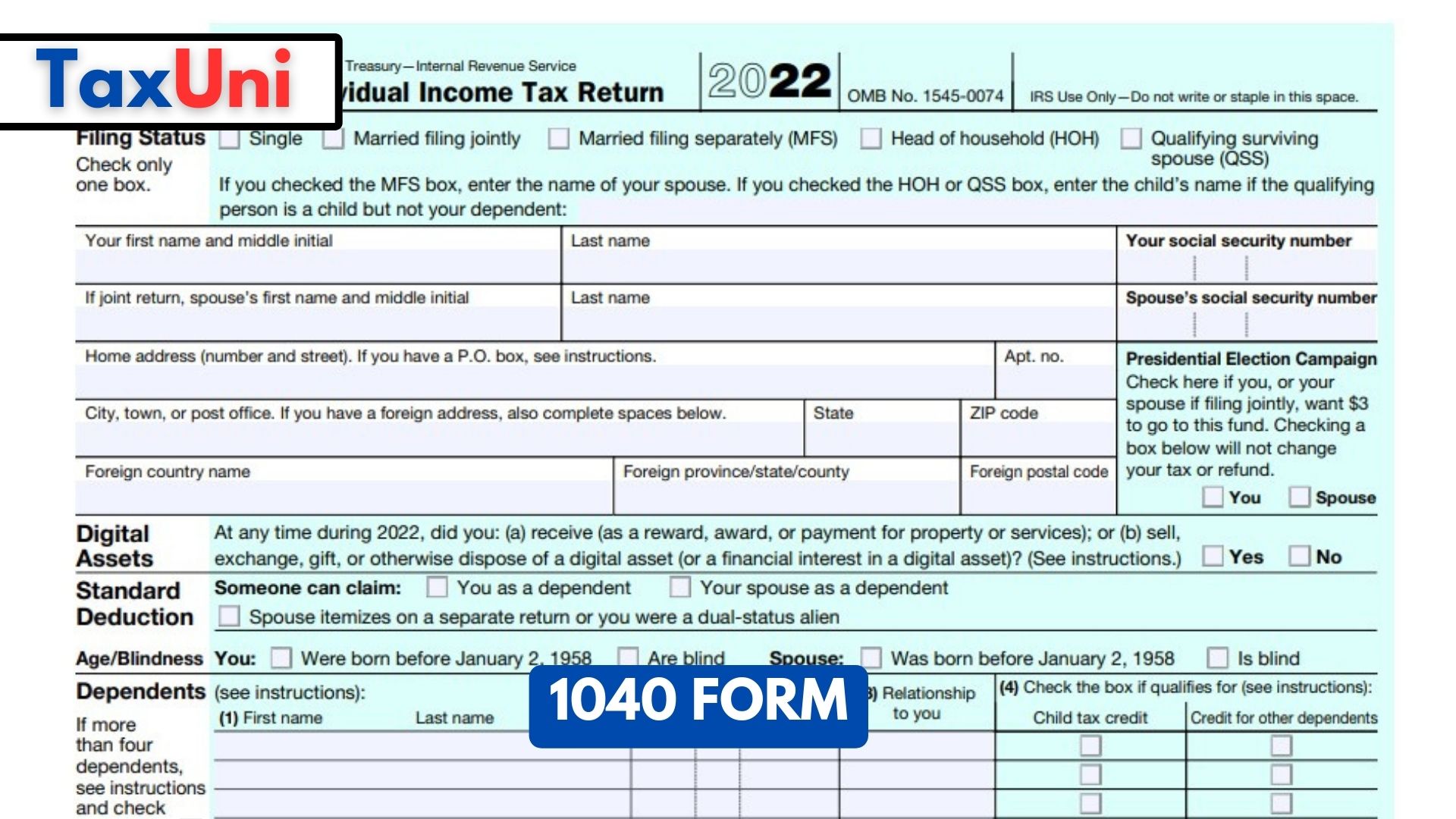

The 1040 form is individual’s main tax return to report their income. It tallies all your income and deductions to determine whether you owe money to the government or will receive a refund. The form also includes supporting forms called schedules that help you accurately report your information. Filing Form 1040 can be simple or complicated, depending on your tax situation and the type of income, deductions, and credits you claim. You can file a return manually using the paper version of the form or use online software to walk you through the process step by step. Depending on your income and deductions, you may need to attach additional schedules with your 1040 filing.

How to Fill Out Form 1040?

Before filling out the 1040 form, gather your W-2s and other records of income and deductions. You may also need to download and print some additional forms, known as schedules, that go with the main form. For example, you might need to complete Schedule A if you itemize deductions instead of taking the standard deduction.

- Start by entering your total income in the Income section, lines 7 – 21. Use the information from your W-2s and other sources of income to enter amounts in the appropriate boxes. Be sure to include all sources of income, including any interest you earned on your savings accounts or investments and any health care benefits you received (such as the Marketplace advance premium tax credit).

- Then, calculate your federal tax liability in the Taxes section, lines 48 – 54. If you owe a penalty because you did not pay enough estimated tax in the previous quarter, see page 74 of the 1040 instructions to calculate and enter the amount on line 79. You can then choose to pay the penalty with a personal check made payable to the United States Treasury or use one of the other methods listed on the instructions for Form 1040.

- After calculating your tax liability, you can sign and submit the 1040 form to the IRS. You can also use this form to request an extension or make a payment. If you’re owed a refund, you can receive it by direct deposit or through the mail. The IRS also offers a variety of other forms and publications that are accessible to those with different abilities, as well as assistive technologies.

Additional Information Related to Form 1040

- Due date for Form 1040: The due date for filing Form 1040 is generally April 15th. However, there are some exceptions to this rule. For example, individuals who live abroad or are military members may be granted an extension.

- Extension for Form 1040: An extension is a request for more time to file Form 1040. Extensions are typically granted for up to six months. Individuals who need an extension must file Form 4868, Application for Automatic Extension of Time to File U.S. Individual Income Tax Return.

- Form 1040-EZ: This is a simplified version of Form 1040. It is designed for individuals who have a simple tax situation and who do not claim many deductions or credits.

- Form 1040-A: This is another simplified version of Form 1040. It is designed for individuals who itemize their deductions and who do not claim many credits.

- Form 1040NR: This is the form used by nonresident aliens to file their U.S. income tax returns.

- Form 1040-ES: This is the form used to make estimated tax payments. Estimated tax payments are required for individuals who expect to owe more than $1,000 in taxes for the year.

- Form 1040-V: This is the form used to amend a previously filed Form 1040.

What Forms Can Be Filed with Form 1040?

- Schedule A: This form is used to itemize deductions, such as medical expenses, charitable contributions, and state and local taxes.

- Schedule B: This form is used to report interest and dividend income.

- Schedule C: This form is used to report income from a business you own and operate.

- Schedule D: This form is used to report capital gains and losses from the sale of stocks, bonds, and other investments.

- Schedule E: This form is used to report income from supplemental sources, such as pensions, annuities, and rental property.

- Schedule F: This form is used to report farm income and expenses.

- Schedule H: This form is used to report household employment expenses.

- Schedule J: This form is used to report credit for business income and net operating loss carryovers.

- Schedule M-1: This form is used to report income from Social Security benefits.

- Schedule O: This form is used to report foreign income and taxes.

- Schedule R: This form is used to claim credit for the elderly or the disabled.

- Schedule T: This form is used to report charitable contributions made to a qualified organization.

- Form 2106: This form is used to deduct employee business expenses.

- Form 2210: This form is used to report underpayment of estimated tax by individuals, estates, and trusts.

- Form 2441: This form is used to report child and dependent care expenses.

- Form 2848: This form is used to give power of attorney to a representative to act on your behalf in tax matters.

- Form 3903: This form is used to deduct moving expenses.

FAQs

What is Form 1040?

Form 1040 is the official form used by U.S. individuals to file their annual income tax returns. It is used to report income, deductions, and credits to the Internal Revenue Service (IRS).

Who needs to file Form 1040?

Generally, all U.S. citizens and resident aliens with taxable income must file Form 1040. There are some exceptions, such as certain nonresident aliens and individuals eligible to file Form 1040-EZ or Form 1040-A.

When is the due date for filing Form 1040?

The general due date for filing Form 1040 is April 15th. However, there are some exceptions, such as individuals who live abroad or are military members, who may be granted an extension.

How do I file Form 1040?

There are three main ways to file Form 1040:

– Electronically: You can file Form 1040 electronically through the IRS Free File program or by using commercial tax preparation software.

– Paper: You can download and print Form 1040 from the IRS website and mail it to the IRS.

– With the help of a tax professional: You can hire a tax professional to prepare and file your Form 1040 for you.

What are the penalties for not filing Form 1040?

The penalties for not filing Form 1040 can be significant. You may be subject to a late filing penalty, a failure-to-file penalty, and interest on any unpaid taxes.

Can I amend a previously filed Form 1040?

You can amend a previously filed Form 1040 using Form 1040-X, Amended U.S. Individual Income Tax Return. You must file Form 1040-X within three years of the original due date of your return.

Where can I find more information about Form 1040?

You can find more information about Form 1040 on the IRS website, including instructions for filling out the form, information on specific deductions and credits, and FAQs.