Contents

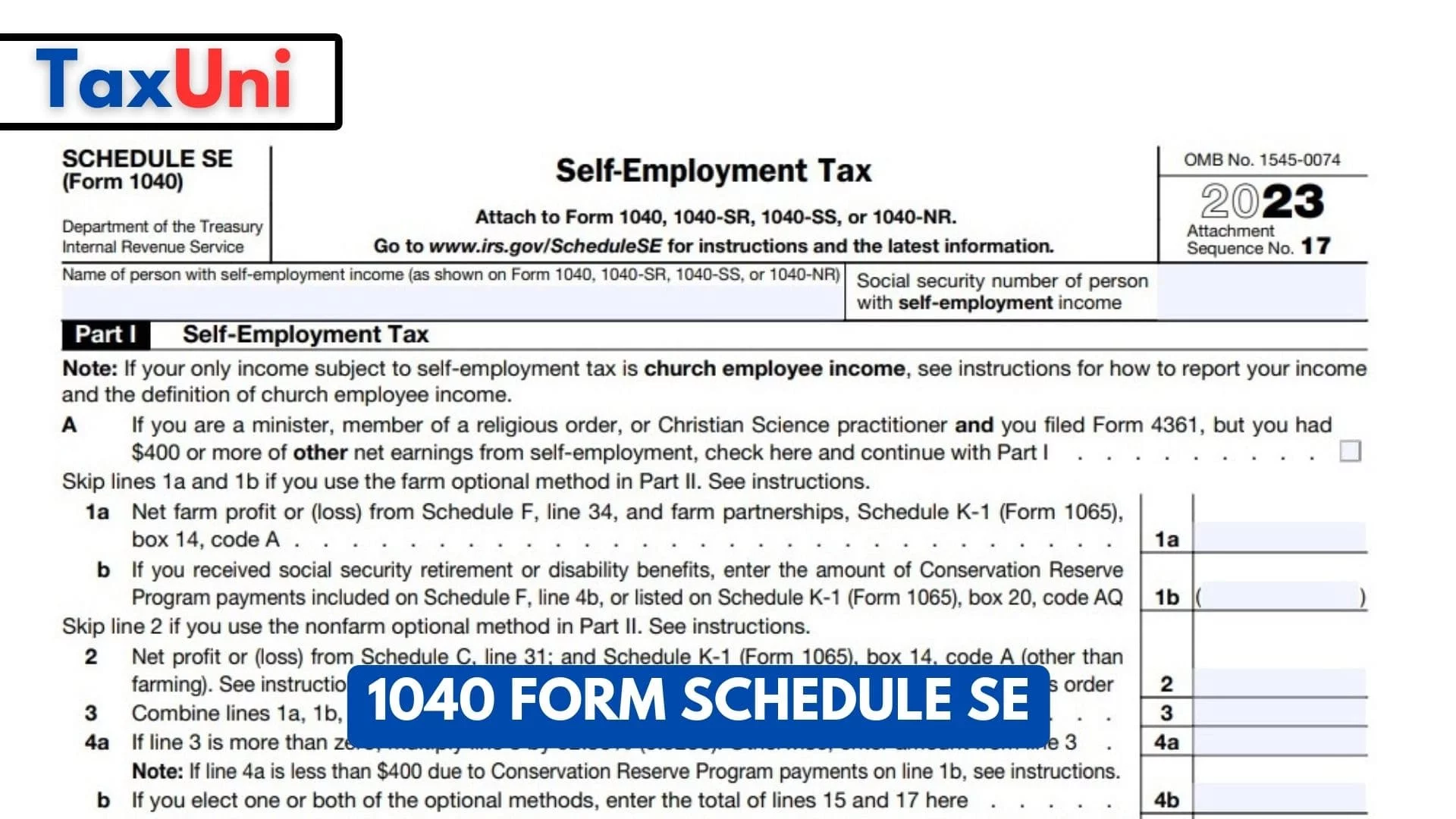

1040 Form Schedule SE is a tax form used in the United States by self-employed individuals to calculate and pay their self-employment tax. This tax covers Social Security and Medicare taxes for those who work for themselves. It’s used to report the amount of self-employment tax owed based on the net earnings from self-employment. The form is filed along with Form 1040 or 1040-SR, the individual income tax return, and helps determine the total tax liability for self-employed individuals.

- The combined self-employment tax rate is 15.3% for 2023. This rate is split evenly between the Social Security tax rate (12.4%) and the Medicare tax rate (2.9%).

- You can file Schedule SE electronically or by mail.

- The deadline for filing Schedule SE is the same as the deadline for filing your Form 1040. This means that you must file your return by April 15th or the due date set by your state, if it is earlier.

If you need help with filing Schedule SE, you can visit the IRS website or call the IRS at 1-800-829-1040.

Who Must File 1040 Form Schedule SE?

Individuals who are self-employed and meet specific income thresholds are generally required to file Form 1040-SE. Specifically, if you have net earnings from self-employment that are $400 or more, you’re typically required to file this form to calculate and pay your self-employment tax. This includes individuals who work for themselves in a trade or business as independent contractors, sole proprietors, freelancers, consultants, and other forms of self-employment.

How to File 1040 Form Schedule SE?

- First, complete your Form 1040, including reporting your self-employment income on the appropriate lines.

- Obtain Schedule SE, which is the form specifically used to calculate your self-employment tax. You can find this form on the IRS website or through tax preparation software if you’re using one.

- On Schedule SE, you’ll calculate your self-employment tax based on your net earnings from self-employment. Follow the instructions provided with the form to compute this tax.

- Once you’ve calculated your self-employment tax on Schedule SE, transfer the calculated amount to your Form 1040. You’ll put the total self-employment tax liability on the appropriate line of your Form 1040.

- Include both your Form 1040 and Schedule SE when filing your income tax return with the IRS. Ensure they are accurately filled out and signed.

- If you owe self-employment tax, make sure to submit payment along with your tax return by the tax filing deadline.

Remember, self-employment tax is in addition to any income tax you might owe, so it’s crucial to accurately calculate and report your self-employment income to determine the correct tax liability.

How to Figure Self-Employment Tax?

There are two main methods that 1040 Form Schedule SE filers can use to figure self-employment tax:

Method 1: Traditional Method

The traditional method is the most common method used to figure self-employment tax. It involves multiplying your net earnings from self-employment by the combined self-employment tax rate, which is 15.3% for 2023. This rate is split evenly between the Social Security tax rate (12.4%) and the Medicare tax rate (2.9%).

Method 2: Optional Method

The optional method is an alternative method that can be used by certain types of self-employed individuals, such as clergy members, religious sisters, Christian Science practitioners, and members of certain recognized religious sects. It involves multiplying your gross income from self-employment by a lower self-employment tax rate, which is 10.6% for 2023. This rate is also split evenly between the Social Security tax rate (8.1%) and the Medicare tax rate (2.5%).

Which Method Should You Use?

The best method for you will depend on your individual circumstances. If you are unsure which method to use, you should consult with a tax advisor.

What is Considered Self-employment Earnings?

Net earnings from self-employment are the total earnings of a self-employed individual from their trade or business, minus allowable business expenses. This amount is used to calculate the self-employment tax, which is a social security and Medicare tax for people who work for themselves.

Calculating Net Earnings from Self-Employment

To calculate net earnings from self-employment, you will need to follow these steps:

- Determine your gross income from self-employment. This is the total of all of your income from your trade or business, such as sales, fees, and commissions.

- Subtract your allowable business expenses from your gross income from self-employment. Allowable business expenses are expenses that are ordinary and necessary for the operation of your trade or business. Examples of allowable business expenses include rent, utilities, salaries, wages, and advertising.

Here is the formula for calculating net earnings from self-employment:

Net earnings from self-employment = Gross income from self-employment – Allowable business expenses

Examples of Allowable Business Expenses

Here are some examples of allowable business expenses:

- Rent

- Utilities

- Salaries and wages

- Advertising

- Office supplies

- Depreciation

- Taxes

- Insurance

- Interest on business loans

- Travel expenses

- Meals and entertainment expenses

Net Earnings from Self-Employment vs. Profit or Loss

Net earnings from self-employment is a different concept than profit or loss. Profit or loss is the net income from a business after all expenses have been paid. Net earnings from self-employment is the amount of income that is subject to self-employment tax.

Difference Between Net and Gross Self-employed

The terms “net” and “gross” are often used interchangeably, but they have distinct meanings in the context of self-employment.

Gross self-employment income refers to the total amount of money an individual earns from their trade or business before any expenses are deducted. This includes all income from sales, fees, commissions, rentals, royalties, and any other sources.

Net self-employment income, on the other hand, is the amount of money an individual has left after subtracting allowable business expenses from their gross income. These expenses include rent, utilities, salaries, wages, advertising, office supplies, and other costs incurred to operate the business.

In essence, net self-employment income represents the actual profit or loss an individual generates from their self-employment activities. It is the amount of money that is used to determine self-employment taxes and is reported on Schedule SE of Form 1040.

Here’s a simplified formula to illustrate the difference:

Net Self-Employment Income = Gross Self-Employment Income – Allowable Business Expenses

For instance, if a freelance writer earns $10,000 in gross income from writing assignments and incurs $3,000 in business expenses, their net self-employment income would be $7,000.

Understanding the distinction between net and gross self-employment income is crucial for accurate tax reporting, financial planning, and evaluating the overall financial health of a self-employed business.