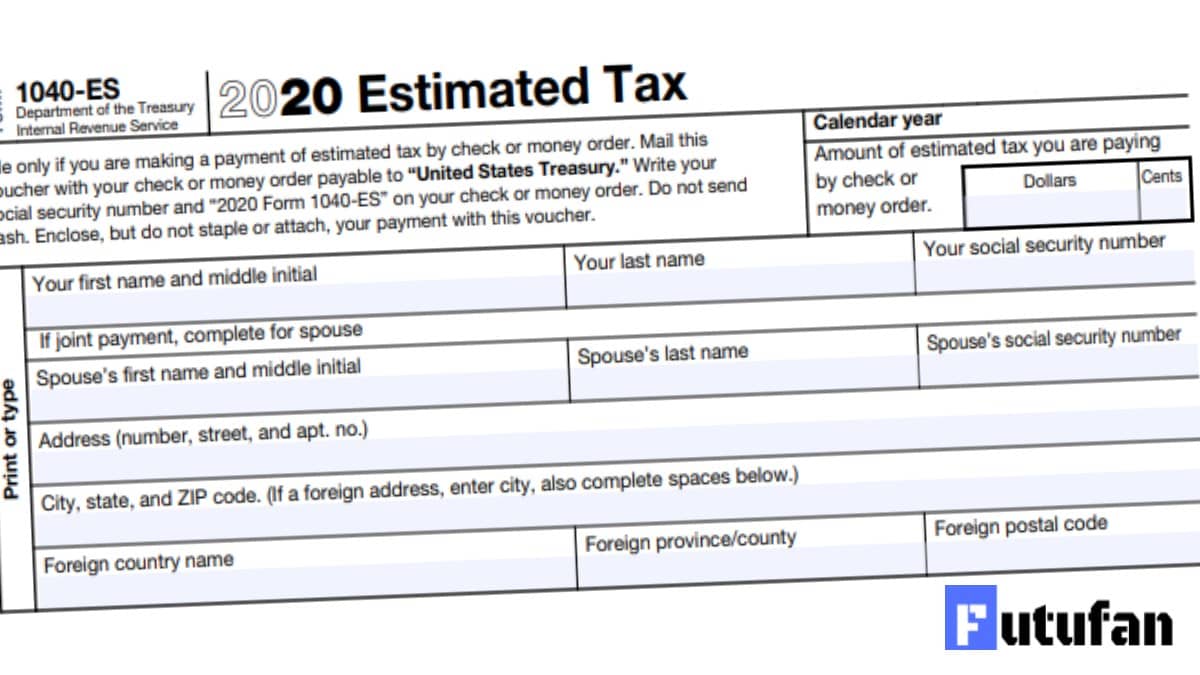

1040-ES Form

Form 1040 ES—Estimated Tax for Individuals is for taxpayers who earn income that isn't subject to withholding. If you're self-employed, you are going to file Form 1040 ES and estimate the taxes you owe and pay the IRS.

Contents

You should submit a 1040-ES form if you are an individual or business owner. You can fill out the form or use a tax preparation service. However, regardless of which option you select, you should be aware of the deadline for submitting your form, as well as the purposes of the form. In addition, you will want to know whether or not you need to file a 1040-ES form electronically and what the deadline is for submitting that form.

What is the purpose of a 1040-ES form?

If you own a business, you may need to file a Form 1040-ES each quarter. The form will help you estimate your tax liability. You’ll need to make payments on time to avoid penalties.

The ES form has four sections that are organized into payment periods. Each unit has a due date. For example, if the due date is April 15, the first payment period will end on June 15 of the current year. If the due date is September 15, the third payment period will end on January 15. This is because a fiscal year is not a calendar year but 12 months.

The worksheet that comes with Form 1040-ES calculates your estimated tax liability. It also shows you your eligible tax credits.

How often are 1040-ES forms required to be filed?

A 1040-ES form is needed when filing for federal taxes. If you are an independent contractor, self-employed, or work for a small business, you may be required to fill out this form regularly. You will need to use the worksheet to estimate your expected income and deductions.

You may be required to pay an estimated tax, depending on your income. Estimated tax payments can be made online or through the Electronic Federal Tax Payment System (EFTPS). The IRS provides an estimated tax payment calculator to help you calculate how much you owe.

An ES form is usually required for taxpayers who expect to owe more than $1,000 in taxes for the year. The form is broken into four sections covering the different payment periods. Each unit has its deadlines.

What is the deadline for submitting a 1040-ES form?

You must file Form 1040-ES if you expect to owe more than $1,000 in income tax for the year. Aside from this, you may have to make quarterly estimated tax payments.

The IRS has a system for making estimated payments through its online Pay Online program. This is a safer way to pay taxes than mailing checks. For this to work, you need to create an EFTPS account. Once you do, you can access a complete suite of personal tax payment options.

You should use Form 1040-ES to calculate your estimated tax if you are self-employed. The form is based on IRS Publication 505, which is used to estimate the income tax you might owe. It includes a worksheet that helps you determine your estimated income and deductions.

Can I file a 1040-ES form electronically?

If you’re self-employed or are receiving a certain income, you may be required to file a Form 1040-ES. This form is an excellent way to calculate your estimated tax and ensure you get all the payments. But if you have no tax liability, there’s no need to file this form.

You can pay your estimated taxes by mail, in person, or online. It’s essential to keep track of your quarterly payments. Also, you should know that the IRS will only apply a penalty if you promptly pay your estimated taxes.

A tax software program can help you estimate your tax liability and calculate your estimated payments. The amount you’re expected to owe for the current year can be calculated by looking at the amount you paid for the prior year’s federal return.

How do I know if I’m required to file a 1040-ES?

The IRS Form 1040-ES is one of the forms that is used to report and pay estimated tax payments. You can file the form digitally or by hand.

You will need to fill out the form if you expect to owe $1,000 or more in income taxes for the year. There are also some instances where you may not have to fill out the form. These are instances when you are a resident of the U.S. and have at least 12 months of residency in the prior year.

Self-employed people must fill out the 1040-ES every quarter. They should estimate their income as they would if they were salaried. Self-employed workers can deduct home office expenses and the cost of home office supplies.

This is due to the federal law requiring taxpayers to pay their federal income taxes gradually. Since certain incomes aren’t subject to withholding, the taxpayer must estimate taxes. If your income is any of the following below, you are required to file Form 1040 ES and estimate the taxes owed.

- Self-employment income

- Interests

- Dividends and other distributions

- Alimony

- Rents

You must file Form 1040 ES for pretty much any income that isn’t subject to withholding.

However, this doesn’t apply to everyone as there are exceptions to this. If you expect to owe less than $1,000 in taxes for the tax season you’re filing after subtracting the taxes withheld and refundable credits, you aren’t required to estimate taxes. If you owe more than $1,000 in taxes but it’s less than 10% of the amount owed in taxes, no need for estimating taxes owed.

In addition to these, you don’t need to estimate taxes if your income doesn’t exceed the minimum income to file a tax return. See the minimum income to file a federal income tax return for 2024 and 2025.

If you are required to estimate taxes, use the fillable Form 1040 ES below.

Online Fillable Form 1040-ES 2025

Note: After you’re done filing, you can print out certain pages by selecting the ones you want to print. Click on the corresponding boxes to enter amounts to estimate taxes.

Making Estimated Tax Payments

Federal estimated tax payments can be made online or at the time of filing Form 1040 ES. We suggest paying it online as it will be easier to keep it for your records.

When paying federal estimated taxes online, you can opt to pay with your credit card or bank account directly to the IRS. If you’re going to make larger payments, it’s best to pay with your bank account as there will be no processing fee.

As for when to make your estimated tax payments, you can pay it by April 15, June 15, September 15, and January 15 for the first to the fourth quarter in order, respectively. There is a small detail on the estimated tax payment deadlines though. If you’re going to file your federal income tax return by February 1st of the following year, you don’t need to make your last payment by January 15.

Learn more about paying federal estimated taxes from here.